Thailand Currency to USD: Live Rate, Converter, 2025 Guide

Planning a trip, tuition payment, or invoice settlement and need Thailand currency to USD? This guide brings together the live reference rate, quick conversions for common amounts, and clear steps to reduce fees. You will also find practical tips for exchanging cash in Thailand, using ATMs and cards, and understanding what moves THB/USD in 2025. All figures are indicative and should be checked against a live quote before you transact.

As of Oct 27, 2025, the reference rate is 1 THB ≈ 0.0306 USD and 1 USD ≈ 32.6900 THB. Short-term volatility has been modest, but retail quotes vary by provider and location. Use the sections below to convert Thai baht to US dollars with confidence.

Rates change frequently; verify live quotes before you exchange. Mid-market rates differ from retail buy/sell quotes due to spreads and fees.

Quick THB to USD converter and today’s rate

When your priority is speed, a simple rate and a few anchor conversions can save time at checkout or at the counter. The reference rate is a neutral midpoint sourced from interbank markets; it is a useful benchmark to estimate what you should receive before fees. Retail services, however, add a spread and may charge explicit fees, so the amount you get can be lower than the benchmark suggests. Always compare any quote you see with an independent live source and check the timestamp.

As of Oct 27, 2025: 1 THB ≈ 0.0306 USD, and 1 USD ≈ 32.6900 THB. Over the last few weeks, day-to-day moves have been relatively contained. Even so, card networks, banks, and cash exchangers update rates on their own schedules, and some apply wider spreads on weekends or holidays. The sections below show today’s indicative range and quick conversions for common amounts so you can sanity-check any quote in seconds.

Today’s THB to USD rate and recent range

Today’s indicative mid-market reference is 1 THB ≈ 0.0306 USD and 1 USD ≈ 32.6900 THB (date-stamped Oct 27, 2025). Recent short-term volatility has been modest, with approximate moves of 0.59% over 7 days and 0.39% over 30 days in October. This means the interbank midpoint has not swung dramatically, but retail quotes can still differ due to provider spreads, weekend policies, and fees.

Rate types in brief: the mid-market rate is the arithmetic midpoint between wholesale buy and sell quotes used by large institutions; a buy rate is what a provider pays you when you sell a currency to them; a sell rate is what you pay when you buy a currency from them. Retail cash and card rates often deviate from the midpoint because providers add a spread and may charge fixed or percentage fees. Actual cash and card rates can vary by city, card network, and shop terminal configuration, so treat public figures as benchmarks only and confirm a live quote before committing.

Quick conversions for common amounts (100–20,000 THB)

Use 1 THB ≈ 0.0306 USD as a quick estimator. Rounded to two decimals to match typical card statements, the following baht-to-dollar conversions are helpful at checkout or when planning a budget. These are pre-fee estimates; your provider’s spread and any fixed charges will change the final figure. If the live rate changes, multiply THB by the current USD-per-THB rate to recalculate.

- 100 THB ≈ 3.06 USD

- 500 THB ≈ 15.30 USD

- 1,000 THB ≈ 30.60 USD

- 10,000 THB ≈ 306.00 USD

- 20,000 THB ≈ 612.00 USD

For the reverse direction, use 1 USD ≈ 32.6900 THB as a reference. Multiply USD by the THB-per-USD rate and round to whole baht for cash planning. These are still pre-fee approximations and can differ from the quote shown by your bank, card network, or exchanger at checkout.

- 20 USD ≈ 654 THB

- 50 USD ≈ 1,635 THB

- 100 USD ≈ 3,269 THB

- 250 USD ≈ 8,172 THB

- 500 USD ≈ 16,345 THB

How to convert Thailand currency (THB) to USD

Understanding the mechanics of conversion helps you avoid mistakes and spot fair quotes. The key is to know which rate you are looking at, confirm the direction of the quote, and apply a simple multiplication. Because most providers quote both a rate and a fee, it is important to judge the total cost, not just the headline number. A consistent approach to rounding and precision also helps your own records match statements later.

Below, you will find the core formulas, worked examples, and tips on finding reliable live rates. You will also see how mid-market rates differ from retail quotes and why this matters when estimating your final amount. Keep amounts rounded to two decimals for USD and to whole baht for cash planning unless your provider specifies otherwise.

Simple formula and example calculations

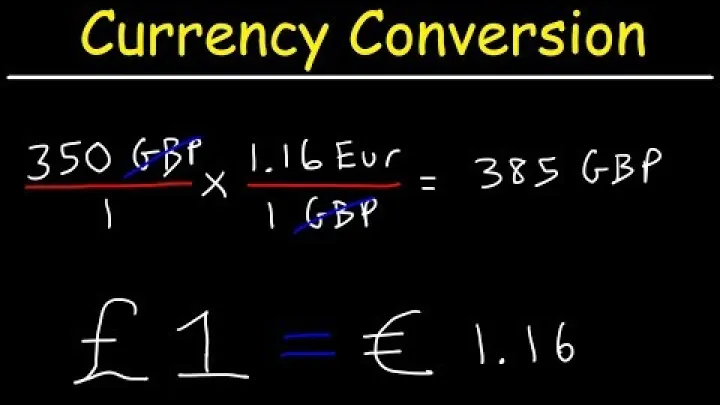

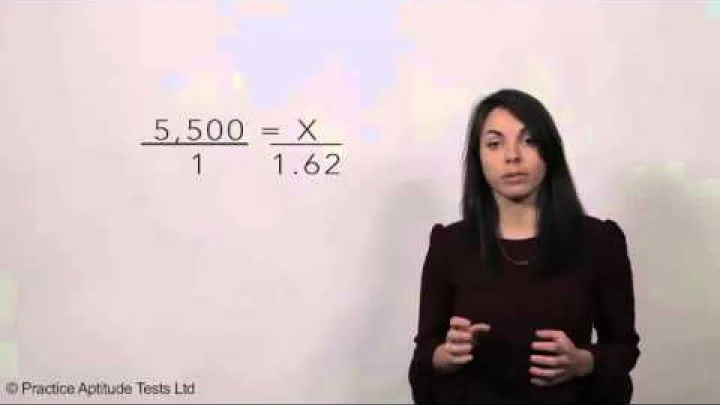

The core formulas are straightforward: USD = THB × (USD/THB rate), and THB = USD × (THB/USD rate). Be careful with quote direction. If the screen shows “USD/THB 32.6900,” that number converts USD to THB. To convert THB to USD using that figure, you would instead use its reciprocal, which is approximately 0.0306. Keep rate precision to four decimals and amounts to two decimals for clarity.

Examples using the Oct 27, 2025 reference: 7,500 THB × 0.0306 ≈ 229.50 USD. For the reverse, 250 USD × 32.6900 ≈ 8,172.50 THB. For estimation, use the mid-market rate. Provider quotes typically include a spread around that midpoint, so your received amount can be slightly less favorable. Reliable live rates are available from major banks, reputable currency converters, and card network rate pages. Always check if a displayed quote is USD/THB or THB/USD to avoid direction errors.

Fees, spreads, and how to minimize costs

Your total cost equals the spread to the mid-market rate plus any explicit fees such as service charges, ATM operator fees, cash-advance fees, wire fees, or card foreign transaction fees. Dynamic currency conversion (DCC) at stores and ATMs often adds 3–7% by applying a poor exchange rate in your home currency. To minimize costs, decline DCC and choose to be charged in THB, compare all-in quotes, avoid airport kiosks for large conversions, and consolidate fewer, larger ATM withdrawals when practical.

Illustrative breakdown for converting 10,000 THB to USD (assumptions for example only, actual costs vary):

- Cash exchange house: Mid-market 0.0306, retail rate 0.0300 (spread ~2.0%), no extra fee. 10,000 THB × 0.0300 = 300.00 USD received.

- ATM withdrawal: Mid-market reference 0.0306. Operator fee 220 THB, bank FX fee 1%. Effective THB amount = 10,000 − 220 = 9,780 THB; converted at 0.0303 net (approx). 9,780 × 0.0303 ≈ 296.33 USD.

- Card purchase in THB: Network rate near mid with 0% issuer FX fee: 10,000 × 0.0305 ≈ 305.00 USD; with DCC accepted by mistake (−4%): ≈ 293.00 USD. Decline DCC to avoid this loss.

Note that buy/sell cash rates differ: a counter may buy your THB at one rate and sell THB at another, and some offer better quotes for higher denominations or crisp notes. Always ask for the final amount after all fees and compare at least two providers.

THB/USD in 2025: recent performance and drivers

The context for 2025 matters if you are planning larger conversions or budgeting for future travel. From January through late October 2025, THB/USD has traded in a relatively contained band compared with past years. While daily moves are usually small, the pair still reacts to economic data, central bank meetings, and shifts in global risk appetite. Understanding what tends to move the baht can help you decide whether to split conversions over time or transact in one go.

Below we summarize the year-to-date picture and the key forces that typically influence direction. Remember that retail quotes can differ from the interbank midpoint due to spreads and timing, so always confirm the latest live rate before executing a transaction.

Year-to-date movements and late-October 2025 trend

Observation window: Jan–Oct 2025. Over this period, THB/USD remained within a relatively narrow range, with October showing indicative volatility of about 0.59% over 7 days and 0.39% over 30 days. The modest swings reflect a balance between tourism inflows, export receipts, and global macro developments. Intra-month ranges have often coincided with travel seasons and energy price moves, factors that affect Thailand’s current account and, by extension, the baht.

It is important to distinguish between the interbank midpoint, which financial institutions trade around, and the retail quotes shown to consumers. Retail spreads can widen during weekends or local holidays, and some providers refresh rates less frequently than markets move. Before converting, glance at a current chart or reputable rate source to confirm the latest direction and avoid surprises caused by stale or padded quotes.

Key drivers: interest rates, inflation, trade, risk sentiment

Interest rate differentials between the US Federal Reserve and the Bank of Thailand influence capital flows. A higher relative US policy rate typically supports the USD versus THB by attracting funds into dollar assets, while a narrowing differential can aid the baht. Inflation trends matter because they shape real yields and central bank guidance. Trade balance and tourism receipts affect baseline demand for THB, with stronger inflows tending to support the currency.

Global risk sentiment and commodity prices, especially oil, also play roles. Periods of risk aversion can lift the USD against many emerging market currencies, including THB, while improving risk appetite can have the opposite effect. Data releases and policy signals around central bank meetings often trigger short-term moves. Multiple drivers interact at once, so avoid attributing any given move to a single factor without broader context.

Practical exchange tips for travelers and businesses

Whether you are buying street food in Bangkok, paying tuition, or settling an invoice, simple habits can improve your rate outcome. Compare all-in quotes, decline dynamic currency conversion, and choose channels that match your needs for speed, cost, and documentation. The guidance below highlights where to exchange, how to use cards and ATMs effectively, and basic hedging ideas for companies with THB/USD exposure.

Policies and fees can change, and practices differ by city and provider. Keep your ID handy for larger transactions, and consider setting alerts on your accounts so you notice unusual charges or declines while abroad.

Best places to exchange and what to avoid

Banks are dependable and widely available, though their spreads can be wider. Airports and hotels are convenient but usually pricier; they are best for small amounts needed on arrival. Avoid unlicensed street vendors, and always confirm that the counter is authorized to trade foreign exchange.

Bring your passport for larger cash exchanges and check any note condition requirements, as some counters offer better rates for newer or higher-denomination bills. Compare at least two quotes against a live benchmark before transacting. Some providers apply different pricing on weekends or public holidays, when interbank markets are closed; the spread may be wider in those periods.

- Checklist when comparing providers: stated rate, explicit fee, final amount you will receive, ID required, receipt availability.

- If possible, transact on weekdays during business hours for tighter spreads.

ATM, card, and transfer options

ATMs in Thailand commonly charge a fixed operator fee per withdrawal, and your home bank may add out-of-network and foreign transaction fees. To limit costs, withdraw fewer, larger amounts when safe, and use a card that charges 0% foreign transaction fees. Always decline DCC at ATMs and merchant terminals to avoid an unfavorable rate in your home currency. Set withdrawal and spending alerts, and verify your daily limits before travel.

Card acceptance is strong in major cities, malls, and hotels, with contactless payments widely supported on international networks. Smaller shops and markets can be cash-first, so carry some baht. For larger remittances or invoice payments, compare the all-in cost and speed of bank wires versus specialist transfer services. Notify your bank about travel dates to reduce the chance of automated fraud blocks and declined transactions.

Hedging basics for businesses

Companies with THB/USD exposure often use forwards, non-deliverable forwards (NDFs), and multi-currency accounts to manage risk. Operational tactics include setting a budget rate for the year, staggering conversions to average costs, and aligning invoice currency with underlying costs to reduce FX mismatch. Regulatory considerations can apply to certain instruments, so coordinate with a licensed bank or broker.

Example: A Thai exporter expects to receive a USD 250,000 payment in 60 days and fears a weaker USD against THB. The firm can lock a forward selling USD/THB at today’s forward rate, fixing the baht amount to be received on settlement. If spot later moves against them, the forward reduces the impact; if spot moves favorably, the forward still settles at the pre-agreed rate. Hedging reduces uncertainty but does not guarantee a better outcome than future spot. This section is educational and not financial advice.

Thai baht basics: code, symbol, and denominations

One baht is subdivided into 100 satang. For everyday use, the most common banknotes are 20, 50, 100, 500, and 1,000 THB. Coins include 1, 2, 5, and 10 THB, plus 50 satang and 25 satang, though the smaller satang coins circulate less in daily retail. The current banknote series features King Maha Vajiralongkorn and includes modern security features such as watermarks, security threads, and tactile marks for accessibility.

Prices in shops and restaurants are typically listed in whole baht, and cashiers may round very small fractions in practice when satang coins are scarce. You will sometimes see the currency written as “Baht” or “THB” on menus and receipts. For card statements and invoices, values are normally shown with two decimals even if the cash amount you pay is a whole number of baht.

Understanding denominations helps when withdrawing or exchanging money. ATMs often dispense 500 and 1,000 THB notes; some smaller merchants prefer 100 THB notes for change. Keep a mix of denominations for taxis and markets, and check that notes are in good condition, as damaged or defaced bills can be rejected by counters and shops.

Regulation overview: exchanging and transferring currency in Thailand

Foreign exchange in Thailand is regulated by the Bank of Thailand and carried out by licensed entities such as banks and authorized money changers. For larger cash exchanges or transfers, providers apply standard know-your-customer checks and may request your passport, visa, or a description of the payment purpose. This documentation supports anti–money laundering obligations and helps ensure that cross-border flows are processed correctly.

Transferring funds into or out of Thailand can involve additional rules. Banks may ask for invoices, contracts, or remittance details to assign the appropriate purpose code. Larger sums can require extra documentation and may be subject to reporting to regulators. Cash import and export rules also apply at airports, and substantial amounts may need to be declared to customs. Thresholds and procedures can change, so confirm the latest requirements with your bank and review guidance from the Bank of Thailand and Thai Customs before moving significant amounts.

In practice, everyday travelers exchanging modest sums face simple procedures at licensed counters. Businesses and individuals making higher-value transfers should plan ahead for compliance checks and processing time. Using authorized channels, keeping receipts, and retaining documentation of the source or purpose of funds will make future transactions and repatriation smoother.

Frequently Asked Questions

What is the currency of Thailand and its code?

The currency of Thailand is the Thai baht with ISO code THB and symbol ฿. One baht is divided into 100 satang. Common banknotes are 20, 50, 100, 500, and 1,000 THB, and coins include 1, 2, 5, 10 THB and 50 satang. The current series features King Maha Vajiralongkorn.

How much is 1,000 Thai baht in US dollars today?

At a reference rate of 1 THB ≈ 0.0306 USD (Oct 27, 2025), 1,000 THB ≈ 30.60 USD. Retail rates vary by provider and fees. Always check a live source (e.g., a bank or exchange app) before converting. Your final amount depends on spreads and any service charges.

Is it better to exchange money in Thailand or before I travel?

You usually get better rates at reputable exchange houses in Thailand than at home or at airports. Exchange only a small amount at the airport for immediate needs, then compare rates in the city. Using ATMs can be convenient but may carry fixed fees and bank charges.

Can I use US dollars in Thailand?

US dollars are not widely accepted for everyday purchases in Thailand; you should use Thai baht. Some hotels or tour operators may quote in USD, but payment is typically settled in THB. Exchange USD to THB at authorized banks or licensed money changers.

Where can I get the best THB to USD exchange rate?

City-center exchange houses (e.g., SuperRich, Vasu, Siam Exchange) often offer competitive rates and transparent fees. Banks are secure but may have wider spreads. Avoid unauthorized street vendors and compare quotes against a live benchmark before transacting.

What fees should I expect when converting THB to USD?

Expect a spread between the buy/sell rate and mid-market, plus possible service or ATM fees. Dynamic currency conversion on cards often adds 3–7% and should be declined. Ask for the total cost and final rate before agreeing to a transaction.

What affects the THB/USD exchange rate?

Key drivers include interest rate differentials, inflation, Thailand’s trade balance, capital flows, and global risk sentiment. US Federal Reserve policy and the Bank of Thailand’s outlook can shift relative currency demand. Tourism and export performance also influence the baht.

When is the best time to exchange THB for USD?

There is no guaranteed best time; short-term moves are hard to predict. Rates can vary within 0.3–0.6% over weeks, so compare providers and avoid high-fee venues. For larger amounts, consider splitting transactions over several days to average the rate.

Conclusion and next steps

As of Oct 27, 2025, the reference rate is 1 THB ≈ 0.0306 USD and 1 USD ≈ 32.6900 THB. Quick estimates for 100–20,000 THB help validate quotes, while awareness of spreads, fees, and dynamic currency conversion can materially improve outcomes. Use the simple formulas to convert in either direction, compare all-in costs across providers, and confirm a live rate before exchanging or paying.

Your Nearby Location

Your Favorite

Post content

All posting is Free of charge and registration is Not required.