Thailand Baht to GBP (THB→GBP): Live Rate, Converter, Fees, and Money-Saving Tips

The Thailand baht to GBP exchange rate changes throughout the day, and small moves can add up when you convert larger amounts. This guide shows you how to convert THB to GBP and GBP to THB, what affects your final costs, and practical ways to pay less in fees. You will find clear formulas, quick conversions for common amounts, and a breakdown of markups, ATM charges, and timing considerations. All examples are illustrative; always check the live mid‑market rate before you exchange or send money.

Today’s THB to GBP rate and quick converter

People often search for “THB to GBP exchange rate today,” “thai baht to gbp,” or “baht to pound” right before a trip or a transfer. The rate you see on market feeds (the mid‑market rate) is the neutral reference point between wholesale buy and sell prices. It is a useful baseline for planning, but the rate you actually receive from a provider usually includes a small spread (markup) and sometimes explicit fees. That is why two services quoting the “same” rate can still deliver different net amounts in pounds.

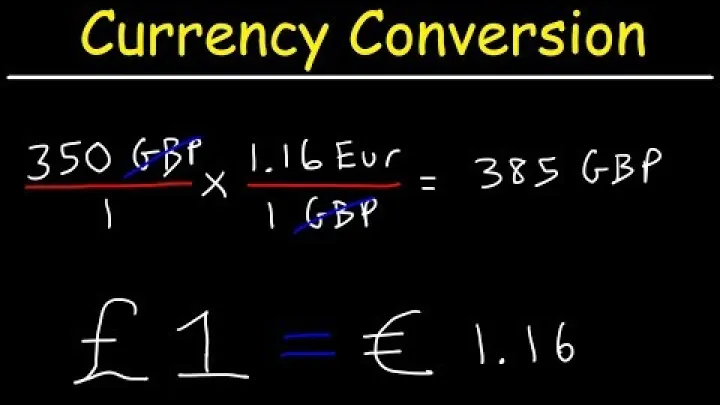

You can convert amounts in two equivalent ways. For baht to pound, multiply THB by the current GBP‑per‑THB rate. For the reverse, divide THB by the THB‑per‑GBP rate. Because division by THB‑per‑GBP is the same as multiplying by GBP‑per‑THB, both approaches produce the same result once you use consistent inputs. Keep a notes app or calculator ready and update the calculation with the latest rate you see on a reputable converter right before paying.

Important reminders for quick checks and fairness of comparison:

- Compare quotes against the live mid‑market rate to estimate the spread (provider markup).

- Account for explicit costs such as flat fees, percentage fees, and any card or bank processing charges.

- Avoid dynamic currency conversion (DCC) on terminals and online checkouts; DCC usually applies a materially worse exchange rate.

- Examples below are illustrative and rounded for readability. Rates and fees update frequently.

How to convert THB to GBP (and GBP to THB): formula and examples

Start with the basic formulas. To convert baht to pound, use: GBP = THB × (GBP per THB). To convert in the other direction, use: THB = GBP × (THB per GBP). These two forms are consistent because dividing by the THB‑per‑GBP rate is equivalent to multiplying by the GBP‑per‑THB rate. When comparing providers, reference the live mid‑market rate as your baseline and remember that most retail quotes include a spread plus possible explicit fees.

Example (illustrative). Suppose the live reference is 0.023 GBP per THB. Then 1,000 THB × 0.023 = 23 GBP. Unrounded calculator output is 23.000000 GBP; a 2‑decimal rounded display is 23.00 GBP. For the reverse, if you see 44 THB per GBP, then 100 GBP × 44 = 4,400 THB. Unrounded output is 4,400.000000 THB; a 2‑decimal rounded display is 4,400.00 THB. These examples exclude fees and assume clean, mid‑market math. Note: these are illustrative calculations only and do not reflect a live quote; always update with a current rate.

In practice, your result may differ due to a spread and explicit charges. For instance, if the mid‑market is 0.0230 GBP/THB but your provider offers 0.0225, then on 10,000 THB the rate difference alone reduces the received amount from 230.00 GBP to 225.00 GBP. If there is also a flat fee, the net GBP falls further. This is why it is helpful to compare two quotes side by side and compute the effective rate you actually receive after all costs.

Timestamp note: these figures are examples only, with rounded and unrounded views to show calculator behavior.

Quick conversions from baht to pound for common amounts

Use the list below for a quick sense check of “baht to pound” amounts commonly searched by travelers, including the long‑tail query “500 thailand baht to gbp.” Values are illustrative, based on 0.023 GBP per THB, and are shown both unrounded and rounded to two decimals for easier budgeting. Always check a live converter for “thb to gbp exchange rate today” before you exchange or pay.

Illustrative conversions at 0.023 GBP per THB (no fees included):

| THB | GBP (unrounded) | GBP (rounded) |

|---|---|---|

| 100 | 2.300000 | 2.30 |

| 500 | 11.500000 | 11.50 |

| 1,000 | 23.000000 | 23.00 |

| 5,000 | 115.000000 | 115.00 |

Reverse example for planning: if the reverse rate is 44 THB per GBP, then 50 GBP ≈ 2,200 THB (50 × 44 = 2,200; unrounded 2,200.000000 THB; rounded 2,200.00 THB). Keep in mind that provider markups and fees change the final figure you receive. Check at least two live quotes and factor in any fixed charges that make small transactions proportionally more expensive.

Important: the final amount you get depends on the provider’s rate and any explicit fees. Airport kiosks, some hotel desks, and DCC on card terminals often apply higher markups than city‑center exchanges or transparent digital services.

Total cost when exchanging THB to GBP

The most reliable way to compare providers is to calculate the effective rate you actually receive after all costs. Two quotes that look similar at first glance can diverge once you include flat fees, percentage fees, or card network charges. The difference can be meaningful on small conversions where a fixed fee takes a larger share, and on larger transfers where a tighter spread saves more in absolute terms.

Exchange rate markups vs. explicit fees

The mid‑market rate is the neutral reference point found on market feeds. A provider’s markup is the spread between this rate and the rate you are offered. For example, if the mid‑market is 0.0230 GBP/THB and you are quoted 0.0225, the spread is 0.0005 GBP per THB. On 10,000 THB, that difference equals 5.00 GBP of rate cost before any explicit fees. This spread is part of the “price” you pay for convenience and service.

Explicit costs include flat fees (for example, a fixed THB or GBP charge), percentage fees, and processing or transfer fees. The real, all‑in price equals the rate spread plus explicit fees. A simple way to compare offerings is to compute your effective rate: Effective GBP per THB = Net GBP received / THB sent. Illustrative example: mid‑market 0.0230; provider rate 0.0225; flat fee 100 THB. Send 10,000 THB. First, convert at the provider’s rate: 10,000 × 0.0225 = 225.00 GBP. Now account for the flat fee’s THB impact in GBP terms using the mid‑market for clarity: 100 THB × 0.0230 ≈ 2.30 GBP. Net GBP ≈ 225.00 − 2.30 = 222.70 GBP. Effective rate ≈ 222.70 / 10,000 = 0.02227 GBP/THB. Comparing this effective rate to the mid‑market (0.0230) shows the total cost per THB. This side‑by‑side method reveals the real difference between providers, especially on 100 or 1,000 THB conversions where fixed fees loom larger.

ATM and card withdrawal fees in Thailand

ATMs are convenient across Thailand, but they often charge foreign cards a fixed local fee. Most major Thai bank ATMs apply a charge around 200 THB per withdrawal, while AEON machines commonly charge about 150 THB. Because these are flat fees, they increase the effective percentage cost of small withdrawals. To reduce the impact, many travelers make fewer, larger withdrawals instead of frequent small ones.

DCC lets you “pay in GBP” on the spot, but it usually uses a poor rate with an extra markup. Let your card network handle the conversion in THB for a fairer rate, then your bank applies any network or foreign transaction fees. Your home bank may add its own charges, such as card FX markups or out‑of‑network ATM fees, which stack on top of the local Thai ATM fee.

Practical limits also matter. Many Thai ATMs cap single withdrawals in the range of 20,000–30,000 THB per transaction, and your card issuer may set daily or monthly limits. Machines usually display fees and limits before you confirm. If you need more cash, you can run multiple withdrawals, but be aware that each one triggers another local fee. Check your bank’s per‑withdrawal and per‑day caps and consider a card that waives foreign transaction fees to improve your all‑in cost.

Where to exchange and how to send money

Choosing where to convert thai baht to GBP or GBP to THB depends on how you value convenience, speed, and price transparency. Options include cash exchanges at airports or city bureaus, bank counters, and digital services that send funds directly to a bank account or for cash pickup. Each path has trade‑offs in exchange rate markups, explicit fees, and settlement time. If you compare at least two channels before confirming, you can usually cut your total cost without sacrificing reliability.

For travelers, having a mix of approaches can be practical: withdraw some cash at an ATM for immediate needs, use card payments in THB where accepted, and plan larger conversions through a provider that shows you the mid‑market rate and the exact fee before you pay. For remittances or tuition payments, digital transfers that provide a guaranteed rate for a short window and clear fees can make budgeting easier.

Cash options (Thailand vs. UK, airport vs. city)

City‑center exchange bureaus in Thailand often offer tighter spreads than airport counters and many UK outlets, especially in popular areas with competitive storefronts. Airport kiosks are convenient on arrival but frequently add higher markups. If you need only a small amount for transport, change a minimal sum at the airport and compare rates at two or more city bureaus before exchanging larger amounts.

Larger, clean banknotes sometimes receive better rates than small or damaged notes. Always confirm the exact rate and calculate the final amount before handing over your cash. Check opening hours, especially on weekends and holidays when availability and rates can differ. During peak travel periods and national holidays in Thailand or the UK, some counters may shorten hours or adjust pricing due to lower liquidity and staffing. Keep safety in mind: avoid counting cash in public and use well‑lit, reputable locations.

Best practice: if you plan to exchange a large amount, ask whether the bureau can reserve a rate for a short period or require ID for larger transactions. Some reputable city bureaus also post their commissions and rates online, making pre‑trip comparisons easier.

Digital transfers: speeds, fees, and reliability

Specialist money transfer services often combine transparent pricing with near‑mid‑market rates, which can be cheaper than traditional bank transfers for many corridors. Delivery times vary from near‑instant to one or two business days, depending on the payment method (bank transfer, card, or local instant rails), the time of day, and standard compliance checks. Some services can deliver to a UK bank account, while others also support cash pickup or mobile wallet options.

Before choosing a provider, check the factors that matter to you: regulation and licensing in your sending country, security controls, maximum and minimum transfer limits, and whether the service offers a guaranteed rate (rate lock) for a set period. Review cancellation or refund policies in case you need to amend details. For larger amounts, verify if you can upload documents in advance to avoid delays. Transparent providers will show the exact fee and the exchange rate before you confirm, helping you predict the all‑in cost and compare with alternatives.

Timing your conversion and market context

There is no single “best time” to convert THB to GBP, but understanding what moves the rate helps you plan. Exchange rates respond to interest‑rate expectations, inflation trends, trade and tourism flows, and shifts in global risk appetite. In practice, spreads can widen on weekends and holidays when wholesale markets are thin, and rates can jump around key policy meetings and data releases. If timing is flexible, monitoring a small set of recurring events and using alerts can improve your chances of a favorable rate without constant watching.

For travelers and students, the simplest approach is to avoid last‑minute conversions at airports, compare two live quotes on a weekday during market hours, and split larger conversions across time if that reduces stress. For businesses and remote workers, a provider that offers short‑term rate guarantees or forward planning tools can reduce uncertainty when paying invoices or salaries.

What moves the THB/GBP rate

Key drivers include interest‑rate differentials between the Bank of Thailand and the Bank of England, domestic inflation trends, and current‑account balances. When the Bank of England is expected to keep rates higher relative to Thailand, GBP can gain versus THB; when Thailand’s growth and current‑account position improve, THB can find support. Market sentiment also matters: in periods of strong global risk appetite, emerging‑market currencies sometimes benefit, while bouts of risk aversion can weigh on them.

Short‑term volatility often clusters around policy decisions and major data releases. A concise monthly checklist to track includes:

- Bank of England policy meetings and minutes

- Bank of Thailand Monetary Policy Committee meetings

- UK inflation, wages, and GDP releases

- Thailand inflation, industrial production, tourism data, and GDP updates

- Energy price developments that affect UK and regional costs

- Global risk drivers, including major central bank signals and broad USD trends

- UK fiscal events such as Budget or Autumn Statement updates

2025 overview in brief and what to watch

For 2025, it is more practical to think in ranges than precise targets. Short‑term moves are common, and markets can reprice quickly after policy speeches, inflation surprises, or growth data. A cautious approach is to prepare for moderate two‑way swings while focusing on the durable drivers: the relative policy paths of the Bank of England and the Bank of Thailand, domestic inflation momentum, and external balances.

Keep an eye on UK budget statements, Thai growth and inflation readings, and tourism recovery trends that influence seasonal THB flows. Energy prices and broad USD strength can indirectly shape THB/GBP dynamics as well. If you track figures or produce internal forecasts, include a dated note to record when the assumptions were last reviewed. For everyday planning, compare live quotes on a weekday, avoid DCC, and confirm total costs before you transact.

Frequently Asked Questions

What is the THB to GBP exchange rate today?

The THB to GBP rate changes throughout the day based on market conditions. Check a live mid‑market feed or a reputable converter for the latest quote before you exchange. Avoid dynamic currency conversion on cards, which often uses a poorer rate. Compare at least two providers to understand the true all‑in cost.

How do I quickly convert Thai baht to British pounds?

Multiply THB by the current GBP‑per‑THB rate, or divide THB by the THB‑per‑GBP rate. Example: at 0.023 GBP per THB, 1,000 THB ≈ 23 GBP (1,000 × 0.023). For reverse math, 1 GBP at ~44 THB means 1,000 THB ≈ 1,000 ÷ 44 ≈ 22.73 GBP. Always confirm the live rate before paying.

Is it cheaper to exchange money in Thailand or in the UK?

Specialist exchange bureaus in Thai city centers often beat UK bank and airport rates. Airport counters in both countries usually have the highest markups. Compare at least two city bureaus or use a transparent digital transfer for better all‑in pricing.

What ATM fees do Thai banks charge foreign cards?

Most Thai bank ATMs charge a flat fee of about 200 THB per withdrawal to foreign cards. Some networks (for example, AEON) often charge around 150 THB. Make fewer, larger withdrawals and always decline dynamic currency conversion to reduce total costs. Your home bank may also add its own fees.

When is the best time to exchange THB to GBP?

There is no guaranteed best time. Spreads often widen on weekends or holidays; rates can move around central bank meetings and major data releases. If you have a deadline, prioritize timely settlement over chasing small rate moves, and compare two live quotes on a weekday.

How much is 500 Thai baht in pounds?

At an illustrative rate of 0.023 GBP per THB, 500 THB ≈ 11.50 GBP. Your actual result depends on the live rate and provider fees or markups. Use a live converter and compare the total cost before confirming.

Should I pay in GBP or THB when offered at checkout in Thailand?

Choose THB. Paying in GBP triggers dynamic currency conversion, which typically applies a worse exchange rate. Paying in THB lets your card network handle conversion at a fairer rate; your bank will then apply any standard card fees.

Are there limits on how much cash I can carry when traveling?

Countries have customs rules and declaration thresholds for carrying cash. Check the latest guidance from Thai and UK authorities before traveling. Declaring large amounts is often required above certain thresholds, and failure to declare can lead to penalties.

Conclusion and next steps

Converting Thailand baht to GBP comes down to three factors: the exchange rate you receive versus the mid‑market rate, any explicit fees, and the timing of your transaction. Use the formulas in this guide to sanity‑check quotes, and compute your effective rate by dividing net GBP received by THB sent. This gives you a clear, apples‑to‑apples comparison across providers.

For everyday needs, avoid dynamic currency conversion, plan ATM withdrawals to minimize fixed local fees, and compare at least two live quotes during weekday market hours. For larger transfers, favor services that show the mid‑market rate, the exact fee, and a guaranteed rate window so you can budget with confidence. Markets move and fees vary, so confirm details shortly before you transact and record the rate you accepted for your own reference. With a consistent process—live rate check, fee comparison, and effective‑rate math—you can reduce costs and convert THB to GBP with fewer surprises.

Your Nearby Location

Your Favorite

Post content

All posting is Free of charge and registration is Not required.

![Preview image for the video "[217] What is the Mid-Market Rate or the Interbank rate? Why is it important?". Preview image for the video "[217] What is the Mid-Market Rate or the Interbank rate? Why is it important?".](/sites/default/files/styles/media_720x405/public/oembed_thumbnails/2025-10/Axl8k_t5iHzXiMB_YEgWgF5ngAQQy--O3Eh9xfOG_jk.jpg.webp?itok=6rIRojbC)