Thailand Currency to PKR Today: Rate, Converter, Fees and Forecast

Looking for today’s Thailand currency to PKR rate and how to convert Thai Baht to Pakistani Rupees quickly? This guide gives you a live-rate overview, a simple THB→PKR converter, and ready-made conversions for amounts many users search for.

Even small changes in the THB→PKR exchange rate can add up, especially on amounts like 1,000, 5,000, or 10,000 THB. Knowing how the rate is quoted, where fees appear, and why providers differ helps you protect your money.

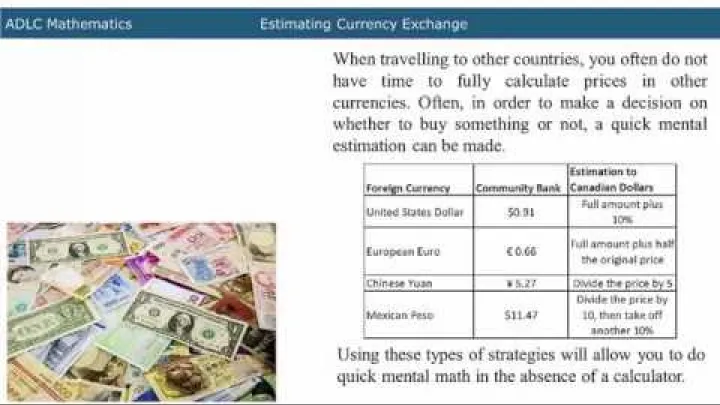

Two concepts guide most conversions. First, there is a mid-market benchmark that sits between wholesale buy and sell prices. Second, retail providers quote their own rates, which usually include a spread, plus they may charge separate fees. Your final outcome depends on both pieces: the quoted rate and every fee on the transaction, including any extra cost for the payment method you choose.

Because rates update minute by minute, it is best to treat any written number as indicative. A small difference in the rate, such as 1–2% on 10,000 THB, can change the PKR you receive by hundreds of rupees. This guide uses rounded examples for clarity and shows you how to recalculate with the current live quote before you commit.

You do not need to forecast the future to make a good decision, but understanding the basics can help you choose timing tools like rate alerts or staged conversions when the amounts are larger.

Today’s THB to PKR exchange rate

Today’s THB→PKR rate typically sits in a tight range and can shift throughout the day as markets react to headlines, economic data, and liquidity. Many public sources display a mid-market reference rate, while banks, apps, and cash kiosks offer retail rates that include a markup. For accurate planning, check an up-to-the-minute quote from your chosen provider just before you fund the transfer or card payment.

Recent observations suggest an indicative live range around 8.59–8.73 PKR per THB. The exact number you get may be a little higher or lower depending on the platform, the size of your transfer, and how you pay. The sections below show how this plays out in practice and provide a quick conversions table so you can estimate common amounts at a sample rate before recalculating with a live quote.

Quick answer and how rates differ by provider

Indicative live range: about 8.59–8.73 PKR per THB, with quotes updating minute by minute. Treat this as a guide and verify the live number with your provider. Mid‑market sources display a neutral reference; retail services usually quote a slightly worse rate to cover costs, and some also add explicit transfer fees.

In simple terms, spreads are the built‑in markups inside a provider’s exchange rate, while explicit fees are the separate charges you see listed at checkout. Your final all‑in rate depends on the provider type, funding method (bank transfer, card, wallet), and the size and urgency of the transaction. Compare both the quoted rate and every fee to see the real “you get” amount in PKR.

Common conversions at a glance (1, 10, 20, 100, 500, 1,000, 5,000, 10,000 THB)

The figures below use a sample rate of 8.65 PKR per THB for quick mental math. These are estimates for illustration only. Always recalculate with the live rate you see on your chosen platform and include all fees to know the final PKR amount that will arrive.

Round to the nearest rupee for everyday use, but keep more decimals during calculation to avoid compounding errors. Even small rounding differences can add up on larger transfers, so confirm totals at checkout before you fund the payment.

| THB | Approx. PKR at 8.65 |

|---|---|

| 1 | ≈ 8.65 PKR |

| 10 | ≈ 86.5 PKR |

| 20 | ≈ 173 PKR |

| 100 | ≈ 865 PKR |

| 500 | ≈ 4,325 PKR |

| 1,000 | ≈ 8,650 PKR |

| 5,000 | ≈ 43,250 PKR |

| 10,000 | ≈ 86,500 PKR |

Remember: spreads and fees change the final numbers. A provider with a 1–2% weaker rate or an additional fee will reduce the PKR your recipient receives. Recheck the quote moments before you commit, especially for amounts like 1,000, 5,000, or 10,000 THB that users commonly convert.

THB to PKR converter and calculation

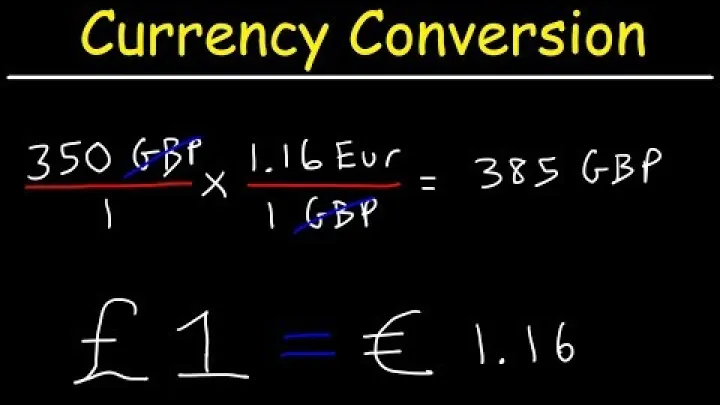

Converting Thailand currency to PKR is straightforward once you know the live exchange rate. You multiply the amount in Thai Baht by the THB→PKR rate to get the gross Pakistani Rupees before fees. If you already know how many PKR you need to deliver, you can divide the PKR amount by the rate to find the required THB. Keeping your steps clear and using enough decimal places helps avoid errors.

Most platforms show both the rate and the estimated fee at checkout. To compare providers, always look at the final “you get” amount in PKR after all charges. If you prefer a manual check, calculate the gross outcome from the headline rate and then subtract any fixed or percentage fees, plus any card surcharge if you are funding with a debit or credit card.

Simple formula and example

The core formula is: PKR = THB × (live THB→PKR rate). The inverse is: THB = PKR ÷ (live THB→PKR rate). For example, using a sample rate of 8.65, 1,000 THB converts to about 8,650 PKR before fees. If you need 20,000 PKR at the same rate, you would need about 20,000 ÷ 8.65 ≈ 2,313 THB before fees.

To see the effect of charges, compare gross vs net. Suppose the gross is 8,650 PKR, the fixed fee is 150 PKR, and the provider’s rate includes a small spread equivalent to about 0.5% of the gross. The 0.5% spread would reduce 8,650 by roughly 43 PKR, and the fixed fee reduces it by another 150 PKR, leaving a net of about 8,457 PKR. This shows why you should always check the “you get” number.

How to avoid rounding errors and hidden spreads

During calculation, keep at least four decimal places for the exchange rate and only round at the end. This keeps small errors from compounding on larger amounts. If your calculator or spreadsheet shows more precision, keep it until the final step and round to the nearest rupee only when you present or book the number.

To spot hidden spreads, compare the provider’s quoted rate to a mid‑market reference from reputable sources. The difference is the spread, which is separate from explicit transfer fees and any payment method surcharge. In practice: the spread is the embedded markup inside the rate, the transfer fee is the listed service charge, and a surcharge can apply to funding methods like cards. Avoid dynamic currency conversion at ATMs or merchants by confirming you want to be billed in THB (or in the local currency of the transaction) to sidestep poor conversion rates.

Fees and providers (banks, apps, money transfer services)

Providers vary by rate quality, fee structure, speed, and support. Banks and traditional money transfer operators may offer wide networks and in‑person service. Online apps often provide transparent mid‑market pricing and fast delivery to bank accounts or cash pickup points. The right choice depends on your priorities: the cheapest all‑in rate, the fastest delivery, or the most convenient funding method.

When comparing, look beyond the headline rate. Some services offer a strong-looking exchange rate but add a fixed fee or a card surcharge. Others show a modest fee but include a wider spread inside the rate. The best way to compare is to focus on the total PKR that will reach the recipient. Also review daily and monthly limits, compliance requirements, and refund or cancellation policies in case you need to amend a transfer.

Mid-market rate vs retail rates

The mid‑market rate is the midpoint between wholesale buy and sell prices and serves as a neutral benchmark. It is not usually the rate you will receive as a retail customer, but it is a useful reference for measuring spreads. Retail providers mark up the rate to cover costs and margin, and they may add explicit fees as well.

A simple illustration: imagine the mid‑market rate is 8.65 PKR per THB. A 2% spread means the retail rate might be about 8.65 × 0.98 ≈ 8.48 PKR per THB. On 10,000 THB, the gross at 8.65 would be roughly 86,500 PKR, while the marked‑up rate at 8.48 yields about 84,800 PKR. That difference of roughly 1,700 PKR occurs before any additional fees, showing how spreads materially affect larger transfers.

Typical fees, spreads, and how to compare

Common charges include fixed transfer fees, percentage fees, FX spreads embedded in the rate, and payment method surcharges (especially for cards). Delivery method can also influence price: cash pickup and instant payouts may cost more than standard bank delivery. Some providers lower fees for bank‑funded transfers or for larger amounts that meet certain thresholds.

The best comparison metric is the final “you get” amount in PKR after all fees and spreads. To standardize your comparison, use a simple checklist:

- Quoted rate vs mid‑market reference (estimated spread)

- All fees: fixed, percentage, and any card surcharge

- Funding method and delivery method options

- Transfer limits, compliance steps, and identity verification

- Estimated delivery time and tracking options

- Customer support, refund policy, and cancellation window

THB/PKR trends and drivers (2024–2025)

THB/PKR has shown moderate day‑to‑day swings with occasional wider moves around economic data or policy headlines. Understanding recent ranges helps frame expectations, even though past behavior does not predict future performance. Travelers and remitters can use this context to decide whether to convert in one go or split amounts over several days to reduce timing risk.

Beyond near‑term market noise, macro fundamentals drive the pair over time. For Thailand, tourism receipts, export competitiveness, inflation, and the central bank’s policy rate are key. For Pakistan, inflation trends, reserve adequacy, policy signals, and import financing needs influence the currency. Global risk appetite and US dollar strength can sway both sides, amplifying or muting local drivers.

30-day and 90-day ranges and volatility

Recent 30‑day observations point to a range around 8.55–8.73 for THB→PKR, which indicates moderate intramonth swings. Looking further back, the 90‑day context shows a wider corridor, with high and low prints near 8.85 and 8.58. These numbers are indicative and rounded; they are helpful for orientation but should not be treated as signals for future moves.

Key macro drivers: inflation, policy, trade, reserves

Thailand’s currency often reacts to tourism seasons, export momentum, inflation dynamics, and the Bank of Thailand’s policy stance. Strong tourist inflows during peak seasons can support THB demand, while softer periods may ease inflows. Stable inflation and credible policy typically help anchor expectations and reduce volatility.

Pakistan’s rupee is sensitive to inflation, the State Bank’s interest rate path, FX reserve levels, and import financing requirements. Policy actions, structural reforms, and external inflows can stabilize conditions, while global risk‑off episodes or commodity price shocks may add pressure. Broader themes, such as shifts in US dollar strength and risk sentiment, can influence both currencies at once.

Outlook and risk management

Short‑term forecasts for THB/PKR suggest the potential for modest mean reversion, punctuated by periodic pullbacks or rallies on data releases and policy news. While some structural forces may favor relative THB strength, uncertainty remains high and day‑to‑day moves are hard to time. For most users, process discipline—comparing providers and verifying the final “you get” amount—matters more than trying to predict the next tick.

Risk management techniques can make a noticeable difference. For larger transfers, consider splitting the amount into several tranches, using rate alerts, or locking a rate when available. These tactics do not guarantee a better outcome, but they can reduce regret from unlucky timing and create more predictable budgets for tuition, invoices, or remittances.

Near-term forecasts to end-2025

The base case many observers discuss is a range‑bound path with intermittent swings, reflecting mixed global growth, shifting risk appetite, and local policy dynamics. Structural factors such as steady tourism and contained inflation in Thailand could support THB on balance, while Pakistan’s policy and reserve trajectory will shape PKR stability.

However, forecasts are not guarantees or financial advice. If timing is important, avoid all‑or‑nothing bets. Instead, consider splitting conversions over time to average out short‑term noise. For fixed‑date obligations, explore rate locks where available, and always validate fees and the final “you get” amount before you fund.

Medium-term scenarios and uncertainty

Upside THB scenario: stronger tourism, steady exports, and well‑anchored inflation support gradual THB gains versus PKR. Stability scenario: both sides manage policy trade‑offs, inflation moderates, and the pair trades within a broad range. PKR upside scenario: reforms, external inflows, and improved reserve metrics lead to better PKR stability versus regional peers.

Because outcomes vary, plan with scenarios rather than a single‑point forecast. Map your obligations against these possibilities and decide how much timing risk you can accept. If the amount is material, use staged conversions, alerts, and transparent providers to manage uncertainty in a structured way.

How to send money from Thailand to Pakistan (step-by-step)

International transfers from Thailand to Pakistan follow a simple sequence: verify your identity, add your recipient, fund the transfer, and track delivery. Costs and speed depend on your provider, payment method, and delivery option. Doing a quick comparison before you fund can save money and time, especially when converting 1,000, 5,000, or 10,000 THB.

Compliance rules apply in both countries. Providers ask for KYC documents, and there may be per‑transaction or monthly limits that vary by account type and verification level. Check these details ahead of time to avoid delays, especially if you plan a large transfer or need same‑day delivery.

Verification, funding, delivery timeframes

Start by completing KYC with a valid ID and providing recipient details such as full name, bank information, and contact. Ensure names match the recipient’s official documents to prevent holds. Some platforms also require proof of address or source of funds for higher limits.

Some platforms also require proof of address or source of funds for higher limits.

Funding options include bank transfer, debit or credit card, and sometimes wallet balance. Bank transfers often have lower costs but may be slower to clear. Cards can be faster but might add a surcharge. Delivery to PKR bank accounts or cash pickup typically ranges from minutes to 1–3 business days. Always check transfer limits and compliance requirements in both jurisdictions before you fund.

Optimization tips for better all-in rates

Compare two or three providers every time, and favor transparent pricing close to the mid‑market rate with clear fees. If possible, batch smaller transfers into one to dilute fixed charges. Some services apply weekend markups or pause interbank updates; where applicable, sending on business days can help.

Use rate alerts, rate locks, or staged conversions for larger amounts to manage timing risk. Avoid cash kiosks when you can, as they often apply wider markups than regulated online platforms. Always verify the final “you get” PKR amount, estimated delivery time, and refund policy before you proceed.

THB and PKR quick facts (denominations and usage)

Understanding the basic features of Thai Baht and Pakistani Rupee helps with cash planning and everyday transactions. Both currencies are issued by their respective central banks, and both rely on a mix of notes and coins, though coins are used more for smaller amounts in Thailand and less commonly in Pakistan.

For remittances, regulated channels are standard. Bank transfers and licensed money transfer operators handle most flows into Pakistan, with tracking and verification steps that aim to protect both senders and recipients. Keeping denominations in mind helps when planning ATM withdrawals or cash pickup amounts.

Thai Baht (THB) basics: code, symbol, denominations

It is issued by the Bank of Thailand. Common banknotes include 20, 50, 100, 500, and 1,000 THB. Coins are used for smaller values and are widely accepted in daily life, especially for public transport, convenience stores, and small purchases.

Pakistani Rupee (PKR) basics: code, symbol, denominations

The Pakistani Rupee uses ISO code PKR and the symbol Rs or ₨. It is issued by the State Bank of Pakistan. Common banknotes include 10, 20, 50, 100, 500, 1,000, and 5,000. Coins circulate less frequently in everyday transactions, with most retail purchases handled using notes.

For inbound remittances, bank transfers and regulated providers are standard practice. There can be transfer limits and documentation requirements depending on the provider and the transaction size. Check current rules and ensure recipient account details are accurate to avoid delays or returns.

Frequently Asked Questions

What is the Thailand currency to PKR rate today and why does it vary by provider?

The THB→PKR rate typically sits in an indicative range around 8.59–8.73 and updates throughout the day. Mid‑market quotes are reference points, while retail providers include a spread and may add fees. Differences in spreads, fees, funding methods, and transfer sizes explain why platforms show slightly different results.

How much is 1 Thailand Baht (THB) in Pakistani Rupees (PKR)?

1 THB is roughly in the 8.6–8.7 PKR area based on recent ranges. Always confirm the live quote at checkout, as a change of even 1% can matter on larger amounts. The “you get” figure after all fees is the best number to compare.

How do I convert fixed amounts like 1,000 or 10,000 THB to PKR quickly?

Multiply the THB amount by the live THB→PKR rate. At a sample rate of 8.65, 1,000 THB ≈ 8,650 PKR and 10,000 THB ≈ 86,500 PKR before fees. Recalculate with your provider’s live rate and include fees to see the final amount.

How can I get the best THB to PKR rate and lower fees?

Compare 2–3 providers each time and prefer transparent mid‑market pricing with clear fees. Batch transfers to dilute fixed charges, avoid high‑markup kiosks, and consider sending on business days where weekend markups apply. Use alerts or locks if timing matters.

Is now a good time to convert THB to PKR based on 2025 trends?

Recent ranges suggest moderate volatility with occasional pulls higher or lower. If timing risk concerns you, split conversions over several days or weeks. For fixed‑date needs, consider rate locks where available and monitor the recent 7–30 day range.

What factors move the THB/PKR exchange rate day to day?

Inflation data, policy decisions, tourism and trade flows, FX reserves, and global risk sentiment all play roles. Movements can be sudden around news, but they often settle back within recent ranges. Diversifying timing can reduce the impact of short‑term swings.

What is the safest way to transfer money from Thailand to Pakistan?

Use regulated providers with transparent quotes and clear delivery times. Complete KYC, confirm recipient details, and fund via secure methods. For larger sums, prefer bank‑to‑bank or reputable online platforms with tracking and responsive support.

Conclusion and next steps

The Thailand currency to PKR rate changes frequently, but a structured approach makes decisions easier. Start with a live reference for THB→PKR, then check a few providers to see the spread inside the quoted rate and any explicit fees. Convert sample amounts like 1,000, 5,000, and 10,000 THB using the simple formula and keep at least four decimals until the final round. Focus on the final “you get” amount in PKR to compare options clearly.

For larger transactions, reduce timing risk by splitting conversions, using alerts, or locking a rate if offered. Keep context in mind: recent 30‑day and 90‑day ranges provide helpful orientation but do not predict future moves. Macro factors such as tourism and policy in Thailand, and inflation, reserves, and reforms in Pakistan, can influence the pair alongside global risk sentiment. Recheck rates and fees right before you commit, and review limits, delivery time, and refund policies to avoid surprises.

Your Nearby Location

Your Favorite

Post content

All posting is Free of charge and registration is Not required.

![Preview image for the video "[217] What is the Mid-Market Rate or the Interbank rate? Why is it important?". Preview image for the video "[217] What is the Mid-Market Rate or the Interbank rate? Why is it important?".](/sites/default/files/styles/media_720x405/public/oembed_thumbnails/2025-10/Axl8k_t5iHzXiMB_YEgWgF5ngAQQy--O3Eh9xfOG_jk.jpg.webp?itok=6rIRojbC)